Operation of EV charging stations in China – Industry News 2311

Preface

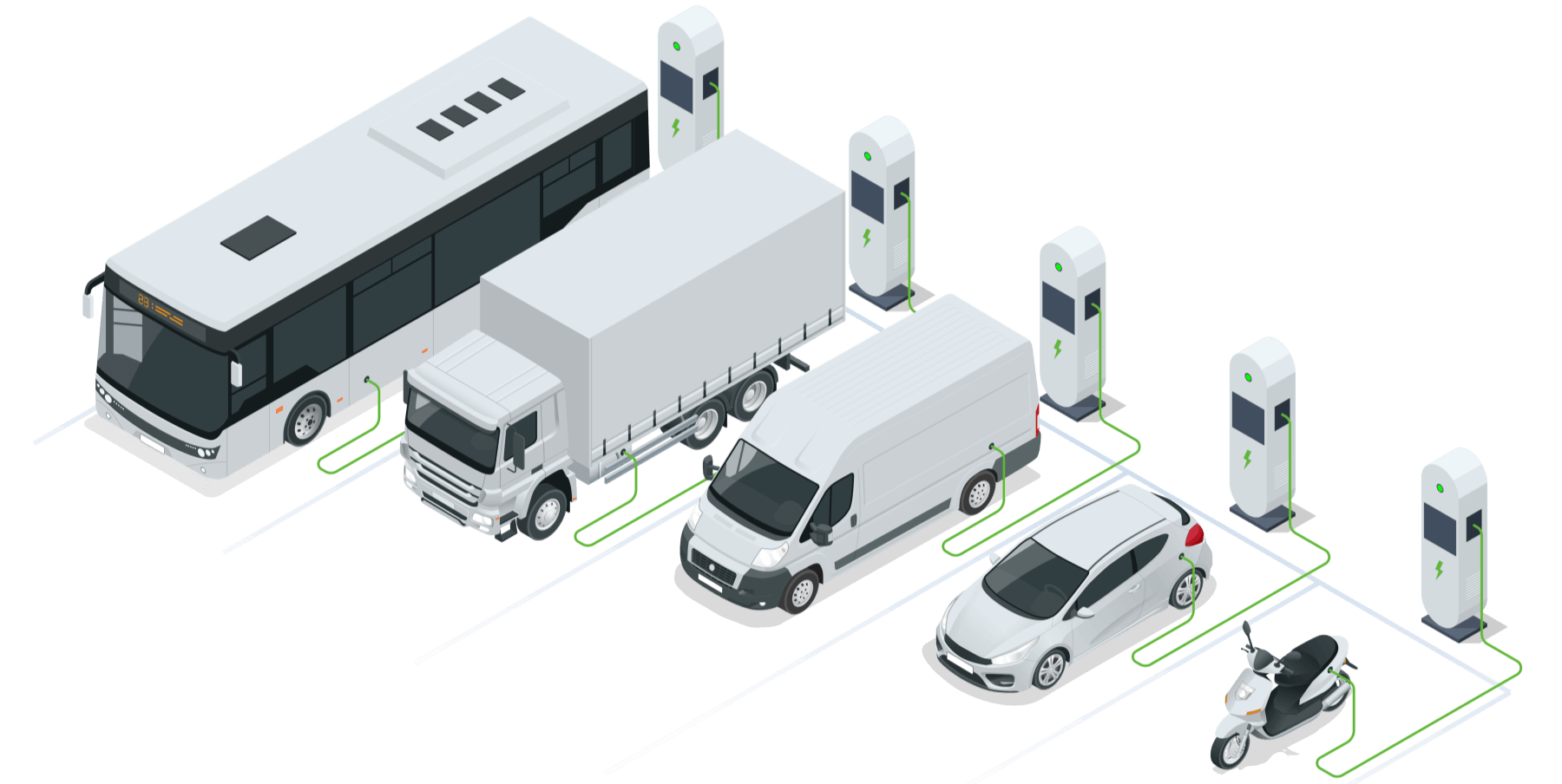

Operation of EV charging stations in China

As a leading electric vehicle powerhouse in the world, China’s operational model for electric vehicles has its advantages and disadvantages. Let’s take a closer look at EV charging stations in China.

EOperational Analysis

Income mode

The market size of EV charging operations is determined by the number of electric vehicles and battery capacity. The revenue of charging operators can be categorized into two types: charging services and non-electric services. The market size of charging services is calculated by multiplying the total amount of electricity charged by the cost per kilowatt-hour, plus service fees. Non-electric services encompass activities such as merchandise sales and advertising revenue.

Pricing

Charging prices vary depending on factors such as location, time, and preferential policies. The fees for charging and battery swapping services are usually regulated by government guidance prices, with different regions implementing varying degrees of preferential policies. Some areas also adopt a time-of-use electricity pricing mechanism to encourage vehicle owners to charge during off-peak hours in order to improve the efficiency of the power system and reduce electricity costs.

Indicator of profitability

The service fee and the comprehensive utilization rate of charging piles jointly determine the profitability level of operators. Among them, the comprehensive utilization rate is calculated as the product of time utilization rate and power utilization rate; where time utilization rate equals effective charging duration divided by total duration, and power utilization rate equals actual output power of a charging pile divided by maximum output power of a charging pile.

Market Features

User behavior

According to the White Paper on Electric Vehicle User Charging Behavior in China 2022, there are three peak periods for charging among new energy vehicle users. These periods occur from 5-7 AM in the morning, 12-4 PM in the afternoon, and 11 PM-1 AM at night, respectively before morning commutes, during lunchtime, and before bedtime. However, these peak charging times do not align with peak electricity pricing.

Most users have a planned approach to charging. According to the data from the white paper, 62% of users pay attention to their vehicle’s remaining battery level and tend to proactively charge it when it falls below 30%, in order to avoid situations where they cannot find available charging stations with low battery levels. Additionally, as many as 91% of users stop charging when their battery level reaches 80%-100%, while 43% choose to fully charge their batteries directly. Only 16% of users opt for a ‘charge-as-you-go, unplug-and-leave’ method.

Nearly 96% of users who utilize public EV charging stations in china prefer fast charging. The majority of these users are sensitive to the duration of their charging sessions, with 96% opting for fast charging and only 4% choosing slow charging.

Commercial EVs

The demand for mid-journey recharging is higher among users of operational and commercial vehicles, such as taxis and commercial vehicles, resulting in significantly increased charging frequencies compared to private cars. Additionally, they have a higher proportion of fast charging usage. Only 7% of private car owners use slow charging, while the percentage is slightly higher at 8% for taxi drivers due to shift changes. On the other hand, ride-hailing and commercial vehicle drivers require continuous driving over long periods more frequently, leading to a greater proportion of fast charging usage.

Different types of new energy vehicle users exhibit different charging patterns. According to the data in the white paper, taxi users experience a peak charging period from 2-6 am due to shift changes, unlike other users. Ride-hailing car users are sensitive to charging prices, so their charging periods are influenced by both electricity pricing mechanisms and peak travel times. Commercial vehicle users have relatively scattered charging periods, while private car users’ charging patterns are associated with their work and travel habits.

EVSE and accompanying services

From the demand side, the existing EV charging stations in china do not fully meet users’ needs. When looking at the usage of various power charging stations, as high as 74% of users choose to charge on 120kW and above charging stations, but the number of charging stations with power greater than 120kW only accounts for 56%. Among them, the usage rate of charging stations with a power of 150kW and above is significantly higher than their construction proportion, indicating that users have a higher demand for fast charging than what is being supplied. In contrast, there is a larger proportion of slow-charging station construction but weak demand. Although charging stations below 30kW account for 24% in terms of construction proportion, their demand only represents 2%.

According to the classification of parking lot charging types, limited-time free parking lots are the preferred choice for vehicle owners to charge their electric vehicles. Taking into account both convenience and cost of parking, these limited-time free parking lots have the highest number of built and used charging stations. The feature of being time-limited and free ensures that owners of new energy vehicles promptly move their vehicles after charging, ensuring a relatively sufficient availability of vacant charging spaces, ultimately creating a virtuous cycle.

EV charging stations in china with supporting facilities are more popular, providing operators with opportunities for increased revenue. The usage rate of charging stations with supporting facilities is significantly higher than those without, at a ratio of approximately 2:1. However, the construction rate tells a different story, as only 27.3% of charging stations are equipped with amenities such as restrooms, dining options, lounges, and convenience stores. This indicates that customers have an underlying demand for these supporting facilities. Among them, charging stations with dining options, convenience stores, and lounges are the most popular choices among users, with utilization rates of 43%, 44%, and 45% respectively. These supporting facilities effectively meet some additional needs of users and alleviate their ‘waiting anxiety’ during the charging process while also representing potential avenues for further revenue growth for operators.

Customer satisfaction

The satisfaction level of users regarding station management and cost rationality is relatively low. According to the white paper’s user satisfaction survey on public EV charging stations in china, it was found that users are generally satisfied with the information display on the charging app as well as the safety and stability of charging. However, their satisfaction level with station management and charging fees is comparatively lower.

The primary sources of dissatisfaction among users are vehicle occupancy and lack of facility maintenance. When it comes to user dissatisfaction with charging station management, 64.4% of users believe that gasoline-powered vehicles and fully charged electric vehicles occupying charging spots seriously affect their normal charging needs. Additionally, 59.8% of users think that the station equipment suffers from wear and tear, aging, and other maintenance issues. Furthermore, problems such as unmanned stations, slow response to reported faults, queue jumping for charging spots have become more prominent. Other issues related to inadequate emergency support during extreme weather conditions and failure to return the charging gun to its original position have gradually emerged in terms of station management.

In various scenarios, the highest level of dissatisfaction is observed on highways. Users generally express higher levels of satisfaction with public charging stations in urban areas and community settings, while dissatisfaction rates are notably high for charging stations along highways, reaching 26.39%. The issue of unsatisfactory highway charging reflects the demand for fast-charging options. The main concerns regarding highway charging revolve around the number of available charging stations and waiting times, highlighting a strong need for improvements in DC fast-charging infrastructure.

0 Comments