Global EV industry accelerates – Industry News 2305

Preface

Global EV industry accelerates

As the global COVID-19 pandemic and supply chain challenges gradually ease, the global EV industry accelerates gradually.

Analysis of the Global EV industry

Previous data

The European market has experienced rapid growth since 2020, with a three-year sales CAGR of 35.3%. European governments such as Germany, the UK, and France have been providing varying levels of subsidies for electric vehicles since 2020. As a result, there has been a year-on-year increase in electric vehicle sales of 144%, 142%, and 29% in the years 2020, 2021, and 2022 respectively.

The European market has experienced rapid growth since 2020, with a three-year sales CAGR of 35.3%. European governments such as Germany, the UK, and France have been providing varying levels of subsidies for electric vehicles since 2020. As a result, there has been a year-on-year increase in electric vehicle sales of 144%, 142%, and 29% in the years 2020, 2021, and 2022 respectively.

In the European market, the CAGR of public charging stations for electric vehicles from 2016 to 2021 is 31.9% higher than the growth rate of electric vehicle ownership. The ratio of cars to charging stations has increased to 15.4:1, indicating a significant supply-demand gap. The sales volume of electric vehicles in Europe continues to grow, with the number of electric vehicles increasing from 600,000 in 2016 to 5.5 million in 2021 at a CAGR of 55.8%.

The number of public charging stations has increased from 122,000 in 2016 to 356,000 in 2021, with a compound annual growth rate (CAGR) of 23.9%. The contradiction between the rapid growth of electric vehicle ownership and the slow pace of public charging station construction is becoming increasingly evident.

The ratio of public charging stations in Europe continues to increase, reaching 15.4:1 in 2021; however, the gap for public charging infrastructure is widening as demand grows. To promote the construction of charging stations, both the European Union and major countries provide subsidies.

Recent data

Entering 2023, the European automotive industry has witnessed a glimmer of recovery in the first quarter. According to data from several major car markets, Europe’s primary automotive markets have all experienced a rebound. In March 2023, total sales in eight European countries (UK, France, Sweden, Norway, Italy, Spain, Finland, Portugal) reached 238 thousand units—an increase of 69.2% year-on-year and a surge of 106.9% month-on-month—with a penetration rate reaching 22.4%.

This is mainly attributed to the continuous alleviation of challenges from the supply chain—as global pandemic conditions gradually improve—automakers have made some progress in addressing supply chain issues (especially chip supplies). Of course, electric vehicle sales overall have performed well in most countries and pure electric vehicles have achieved impressive results. However, Germany lagged behind due to subsidy cancellations for PHEVs. The demand for electric vehicles in Europe as a whole has exceeded our original expectations.

Recent Policies in European Countries

UK: Tightening policies on electric vehicle incentives. In March, sales of electric cars reached 65,000 units, marking a year-on-year increase of 16.6% and a month-on-month increase of 279.0%. The penetration rate stood at 22.4%, which is down by 0.3 percentage points compared to the previous year.

France: Plans to introduce a rental subsidy program, with the potential for further growth in the penetration rate, are underway. Electric car sales reached 101,000 units in March, marking a year-on-year increase of 221.6% and a month-on-month increase of 84.2%. As a result, the penetration rate rose by 2.3 percentage points compared to the previous year, reaching 24.2%.

Norway: Introducing two new taxes for pure electric vehicles for the first time, in March, electric car sales reached 17,600 units, marking an 18.2% YoY increase and a staggering 163.2% MoM growth rate. The penetration rate stands at 91.1%, showing a slight decrease of 0.8 percentage points compared to last year. Starting from 2023, Norway will implement two new taxes specifically targeting pure electric vehicles: a weight-based tax of NOK12.5 per kilogram for vehicles weighing over 500 kilograms and a value-added tax (VAT) of 25% on the portion exceeding NOK500,000 (approximately €47,000) in the price of pure electric cars.

Italy: Subsidies for new energy vehicles will be increased from 2023. In March, the sales of new energy vehicles reached 15,500 units, showing a year-on-year increase of 46.6% and a month-on-month increase of 47.5%. The penetration rate was 9.1%, which is up by 0.4 percentage points compared to the previous year. Italy plans to enhance subsidies for electric vehicles starting in 2023 in order to promote their development. Subsidies for individuals with an income below €30,000 will be increased to €4,500/€3,000 respectively; while those who scrap their old vehicles or have an income exceeding €30,000 will receive subsidies of €5,000/€4,000 for purchasing pure electric/hybrid cars respectively.

Sweden: Canceling subsidies for electric cars resulted in a year-on-year increase of 13.6% and a month-on-month increase of 81.8%, with sales reaching 18,100 units in March. Additionally, the penetration rate also rose by 4.3 percentage points to reach 59.9%.

Spain: The implementation of the MOVES III plan aims to allocate subsidies for the purchase of electric vehicles. In March, sales of electric cars reached 10,300 units, showing a year-on-year increase of 60.7% and a month-on-month increase of 26.7%. The penetration rate currently stands at 10.3%, which is a decrease of 0.3 percentage points compared to the previous year.

Finland: The electric vehicle subsidy policy continues to be effective. In March, sales of electric cars reached 0.43 million units, showing a year-on-year increase of 58.5% and a month-on-month increase of 41.3%. The penetration rate is now at 55.4%, which represents an increase of 19.8 percentage points compared to the same period last year.

Portugal: Electric cars enjoy tax incentives, with pure electric vehicles being exempt from corporate income tax and plug-in hybrid vehicles benefiting from reduced corporate income tax. In March, the sales of electric cars reached 5,800 units, marking a year-on-year increase of 92.9% and a month-on-month increase of 30.5%. The penetration rate rose to 24.0%, up by 1.5 percentage points compared to the previous year.

Germany: The sales of electric vehicles in the first quarter reached 132,281 units, a year-on-year decrease of 13%. Among them, BEV sales reached 94,736 units, showing a year-on-year growth of 13% and accounting for 15.7% of the total. PHEV sales amounted to 37,545 units, experiencing a year-on-year decline of 45% and representing a share of only 6%. Starting from 2023, Germany will reduce subsidies for pure electric vehicles and eliminate subsidies for plug-in hybrid vehicles. However, the enthusiasm of Germans towards electric cars remains high.

United States: Under the IRA policy subsidies, it is expected that electric vehicle sales will experience rapid growth starting in 2023, which will worsen the problem of insufficient charging infrastructure. The United States has seen slow growth in electric vehicle ownership, with sales declining by 9.4% and 9.8% in 2019 and 2020 respectively. The number of electric vehicles on the road has gradually increased from 600,000 in 2016 to 2 million in 2021, with a Compound Annual Growth Rate (CAGR) of only 27.2%, significantly lower than that of China and Europe at -25.1% and -28.6% respectively.

EV charging of EU/US/CN

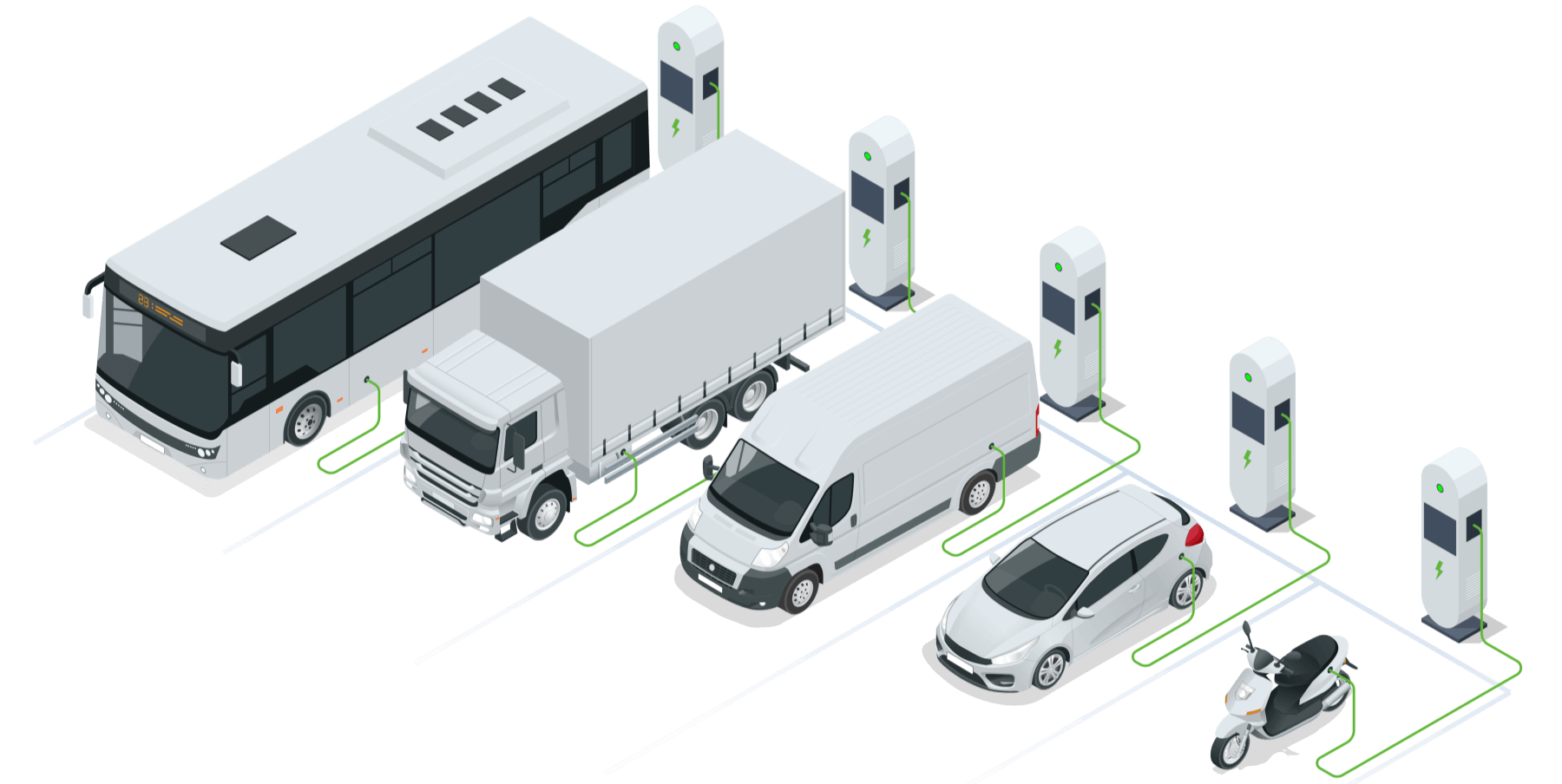

In terms of the global perspective, the construction pace of charging stations lags behind that of electric vehicles, and there is a significant infrastructure gap in major markets.

- In China, by 2022, the ratio of cars to charging stations is 2.5:1; however, there is a structural problem with insufficient public charging stations.

- In Europe, the rapid growth in electric vehicle sales since 2020 has exacerbated the shortage of charging stations. In 2021, the ratio of public chargers to cars was approximately 15.4:1.

- In the United States, although electric vehicle sales have been rapidly increasing since 2021, total sales for 2022 were only at 990 thousand units. The ratio of public chargers to cars reached as high as 17.5:1.

0 Comments