Obstacles in US EV industry- Industry News 2309

Preface

Obstacles in US EV industry

Recently, the US has been promoting the development of its domestic EV industry through various bills and subsidy policies. However, there are still numerous obstacles in US EV industry.

Government’s measures

The US government has recently adopted a dual approach of rewards and penalties to strengthen domestic production of electric vehicles. On one hand, subsidies and loans are being provided to automobile and battery manufacturers, while on the other hand, emissions and energy consumption regulations for automobiles are being tightened to promote the transition towards electrification in the automotive industry. However, there is a widespread belief within the US automotive industry that the current policy goals set by the government are ‘unrealistic’ and overlook the current state of development in this sector. Additionally, government intervention in the electric vehicle supply chain under the pretext of ‘safety’ has also brought further challenges to industrial development.

Stanford University’s Institute for Economic Policy Research recently released a report stating that the United States is stimulating electric vehicle manufacturing through subsidy policies outlined in the Inflation Reduction Act and Bipartisan Infrastructure Bill, while also pushing car manufacturers to transition towards electrification by implementing stricter fuel efficiency and emission regulations. The objective of this series of policies is to support domestic electric vehicle manufacturing, strengthen the supply chain, and enhance America’s competitiveness.

Encouragement policies

In the field of electric vehicles, the US government has recently been investing heavily. The White House announced that it will allocate $2 billion from last year’s Inflation Reduction Act to accelerate domestic electric vehicle manufacturing and rescue struggling car companies. Additionally, in late June, the US Department of Energy granted a $9.2 billion loan for a joint venture between Ford Motor Company and South Korean SKOn to produce electric vehicle batteries, marking it as the largest loan ever given by the DOE Loan Programs Office.

The United States also encourages car manufacturers to enhance the “Made in America” initiative through conditional subsidy policies. In April, the U.S. Department of Treasury issued new regulations for electric vehicle subsidies, which require manufacturers to assemble electric vehicles in North America to be eligible for a $7,500 tax credit. Additionally, a certain proportion of key minerals used in batteries must be extracted or processed in the United States or countries with free trade agreements with the United States.

Punitive measure

The United States is continuously tightening emission regulations, “forcing” car manufacturers to undergo transformation. Recently, the National Highway Traffic Safety Administration (NHTSA), a subsidiary of the U.S. Department of Transportation, announced a proposal that requires automakers to enhance fuel efficiency in vehicles. From 2027 to 2032, passenger cars must increase their fuel efficiency by 2% annually, while light-duty trucks must increase theirs by 4% annually; otherwise, they will face substantial fines. Reuters reports indicate that this proposal may compel car companies to make a significant shift towards electric vehicles in order to avoid penalties. 修改部分:

Previously, the United States Environmental Protection Agency proposed what is hailed as the ‘strictest ever’ automotive exhaust emission standards. The agency stated that starting from 2027, newly sold passenger cars and light-duty trucks in the United States must reduce their greenhouse gas emissions by an average of 13% annually, with a goal of achieving at least a 56% reduction by 2032. According to reports from the Associated Press, this means that approximately 67% of new vehicles sold in the United States will need to be electric cars by 2032.

Problems arise

The dual measures of rewards and punishments in the United States have had a certain impact on the electric vehicle industry. Recently, companies such as electric car and battery manufacturers have started investing in factories in the US after receiving policy incentives. However, analysis points out that the development of the US electric vehicle industry faces multiple constraints.

Material supply

The New York Times reported that the United States heavily relies on imports for critical minerals and battery components. However, the processing and refining efficiency of key mineral resources in the US is low, making it difficult to achieve localized supply of raw materials. According to the 2023 Mineral Commodity Summary report by the US Geological Survey, there are approximately ten minerals, including graphite, that the US imports 100% net. Analysis from consulting firm Gartner suggests that it will not be feasible for the electric vehicle supply chain to completely shift into American hands in the coming years.

Intense competition

Currently, Tesla dominates the electric vehicle market in the United States, while other car manufacturers have entered this field relatively late with weaker technological capabilities, lower brand recognition, limited competitiveness, and development scale. As competition intensifies within the industry, many car companies face pressure to achieve profitability and sustain investment expansion. Additionally, due to complex legal regulations and approval processes for factory construction investments in the US, it often takes 2-4 years or even longer to complete a building project. Moreover, labor shortages and frequent strikes in American manufacturing have also slowed down factory production progress in recent years.

Cost of transformation

The “Automotive Innovation Alliance,” an industry organization in the United States that includes manufacturers such as General Motors, Ford, and Toyota, recently stated that the government’s new emission regulations would significantly increase costs for automakers. According to predictions, these new standards are expected to result in an average cost increase of $633 per vehicle by 2027 and $1200 per vehicle annually by 2032.

Outdated infrastructure

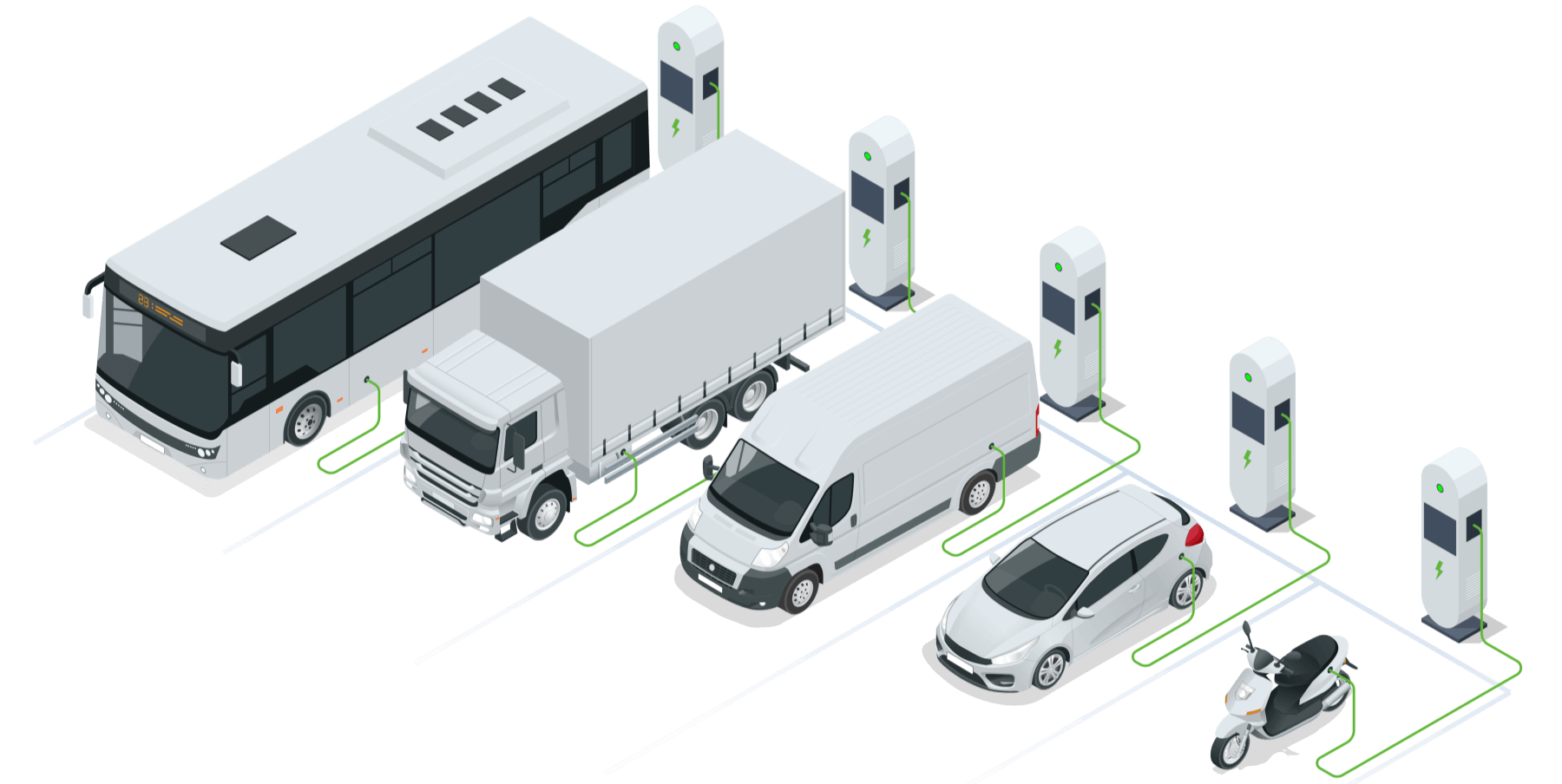

Insufficient charging infrastructure and a weak power grid have also hindered the development of electric vehicles in the United States. According to data from the International Energy Agency, there are currently about 130,000 public charging stations in the United States, resulting in a significant demand gap with a ratio of 23 cars per charger. Additionally, a report by market research firm J.D.Power states that many public charging stations in the United States suffer from software and hardware failures, leading to a high failure rate of 20% for electric vehicle owners trying to charge their vehicles by 2022. The Guardian reported that inadequate electricity transmission facilities in the United States also make long-distance power transmission difficult.

0 Comments