Shell Energy Services Transformation – Industry News 2312

Preface

Shell Energy Services Transformation

The conflict between Russia and Ukraine has altered the energy situation in Europe, as well as plans of Shell Energy services transformation.Shell’s goal of achieving net-zero carbon emissions by 2050 remains unchanged; however, there have been adjustments made to the pathway for energy transition.

Brief Description

Shell’s “Empowering Progress” strategy, which was released in February 2021, outlines the specific path for its energy transition. One year after the strategy was announced, the conflict between Russia and Ukraine erupted, leading to a surge in international oil prices. Simultaneously, several European countries faced gas shortages due to their refusal to import natural gas from Russia, resulting in high volatility of international gas prices.

On January 1, 2023, Wael Sawan replaced Shell’s CEO. Under Sawan’s leadership, Shell has redefined its path for energy transition: firstly, investments in the oil sector will shift from reduction to maintaining stability; secondly, there will be selective investments in renewable energy sources such as wind power and solar power while focusing on three categories of projects – hydrogen energy, biomass energy, and CCUS (carbon capture utilization and storage); thirdly, specific targets for emerging businesses like electric vehicle charging will no longer be set as quality is prioritized over quantity.

Detailed Description

Oil Production

The original plan of the “Empowering Progress” strategy was based on Shell’s oil production in 2019. By 2030, there would be a yearly reduction of 1%-2% in oil production, amounting to a total decrease of 20%. In 2019, Shell’s daily oil production was at 1.9 million barrels per day (bpd). However, by the first quarter of 2023, Shell’s oil production had already dropped to 1.5 million bpd.

Shell China’s Chairman, Chen Lin, stated that Shell has already achieved its target for oil production cuts ahead of schedule and will not continue to reduce production in the short term. Instead, the focus will be on energy security and ensuring a stable supply. This does not imply a complete change in strategy for ‘Empowering Progress.’ Over the past two years, Shell has acknowledged the complexity of energy transition and aims to establish a new energy system while ensuring the security of oil and gas supply.

Not only Shell, but all oil companies are increasing their investments in the upstream sector. According to statistics from Yu Ling and Xia Chuyang at the China Petroleum Economic and Technological Research Institute, in the first half of 2023, international major oil companies primarily focused on new investments in the upstream sector, with upstream capital expenditure accounting for 70% of total expenditure. This represents a significant increase compared to less than 60% in 2022, reversing the trend of declining upstream investment from 2014 to 2021.

New Direction

In a March 2023 interview in Beijing, Wael Sawan stated that Shell is actively working towards establishing a low-carbon business sector, with hopes of profiting from it in the future. However, this will take time as there are still many regions around the world that continue to rely on fossil fuels, which account for over 80% of the overall energy sources.

“It is not feasible to have profit without sustainable development, and sustainable development cannot be achieved without the support of profit. Both are necessary. We need to continue supplying oil and natural gas to meet the current energy needs of people while allocating a portion of these profits towards investing in future low-carbon energy systems,” said Wael Sawan.

Actual Operation

Shell previously announced its “Empower Progress” strategy, which involves restructuring the company’s business into three segments: Transformation Support, Traditional Upstream, and Future Growth. The Transformation Support segment includes integrated natural gas, chemicals, and refining product production and sales. The Traditional Upstream segment refers to upstream exploration and production of oil and gas. The Future Growth segment encompasses downstream sales, biofuels, renewable energy, and energy solutions. Investment in the Future Growth segment as a proportion of capital expenditure will increase from 16% in 2020 to 35%-40% after 2025.

During the period of 2022, Shell’s total external investment amounted to $25 billion, with $4.2 billion invested in renewable energy and $3.8 billion invested in non-energy products, accounting for nearly one-third of the investments directed towards zero-carbon or non-energy products. The remaining two-thirds were primarily allocated to oil and gas.

In 2023, Shell made another adjustment to its business structure by merging natural gas with its traditional upstream operations and consolidating renewable energy, midstream refining, and downstream businesses. This change brings Shell’s business structure closer to that of a conventional oil and gas company.

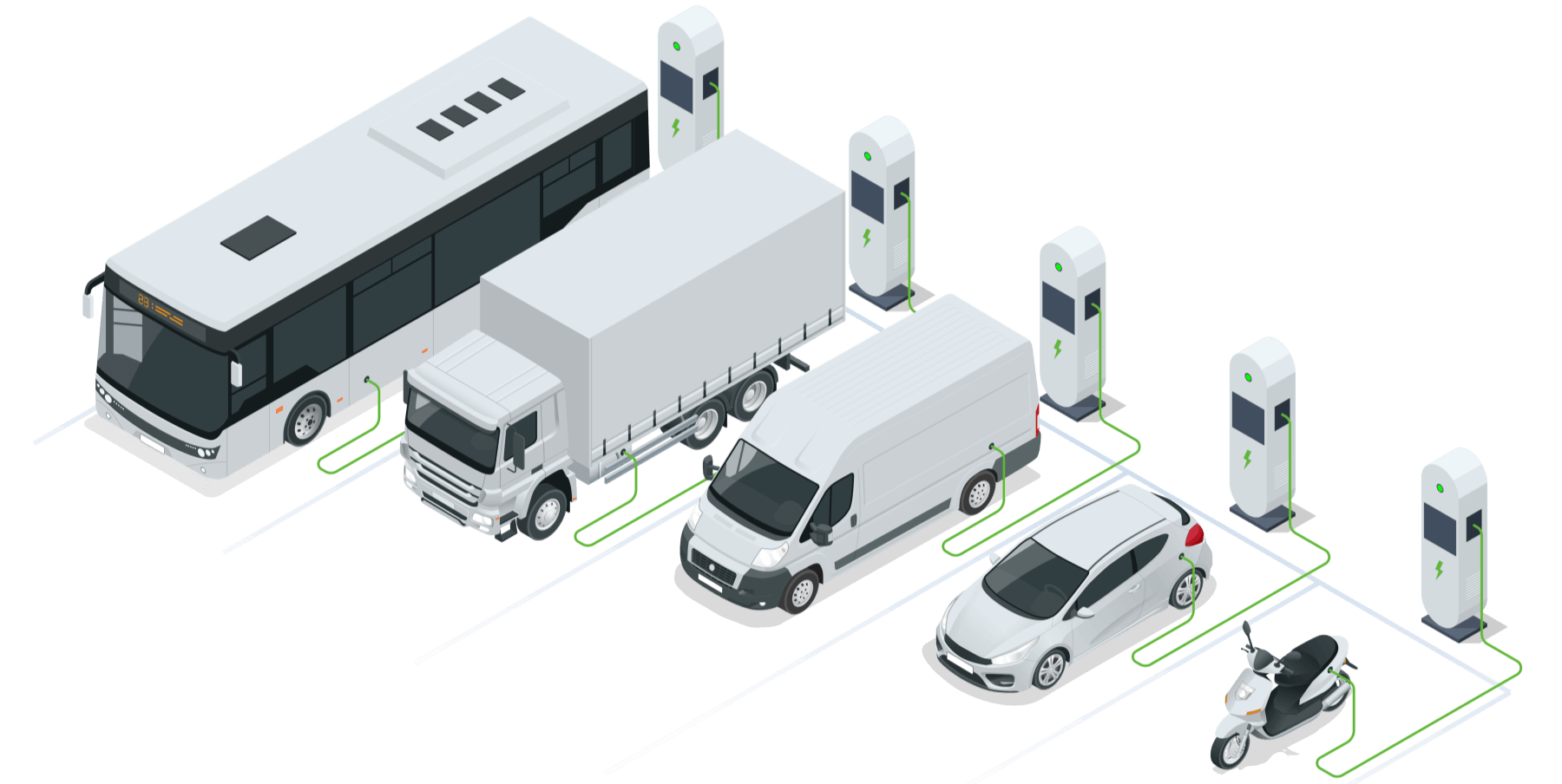

During Investor Day, Shell announced its plan to invest $10-15 billion in renewable energy from 2023 to 2025, demonstrating the company’s commitment to sustainable and low-carbon solutions. Specifically, Shell will prioritize hydrogen energy, biomass energy, CCUS (carbon capture utilization and storage), and electric vehicle charging.

In EV Charging

Shell prefers to use the acquisition model for developing its global charging station business. Previously, Shell has acquired three relevant companies in Europe and America: NewMotion – one of the largest EV charging companies in Europe; Greenlots – a leading provider of electric vehicle charging and energy management software solutions in the United States; and Ubitricity – the largest public electric vehicle charging network service provider in the UK. In China, Shell has established a joint venture with BYD, China’s largest electric vehicle manufacturer, to jointly develop their charging business.

0 Comments