Analysis of 2024 China EV charging industry – Industry News 2401

Preface

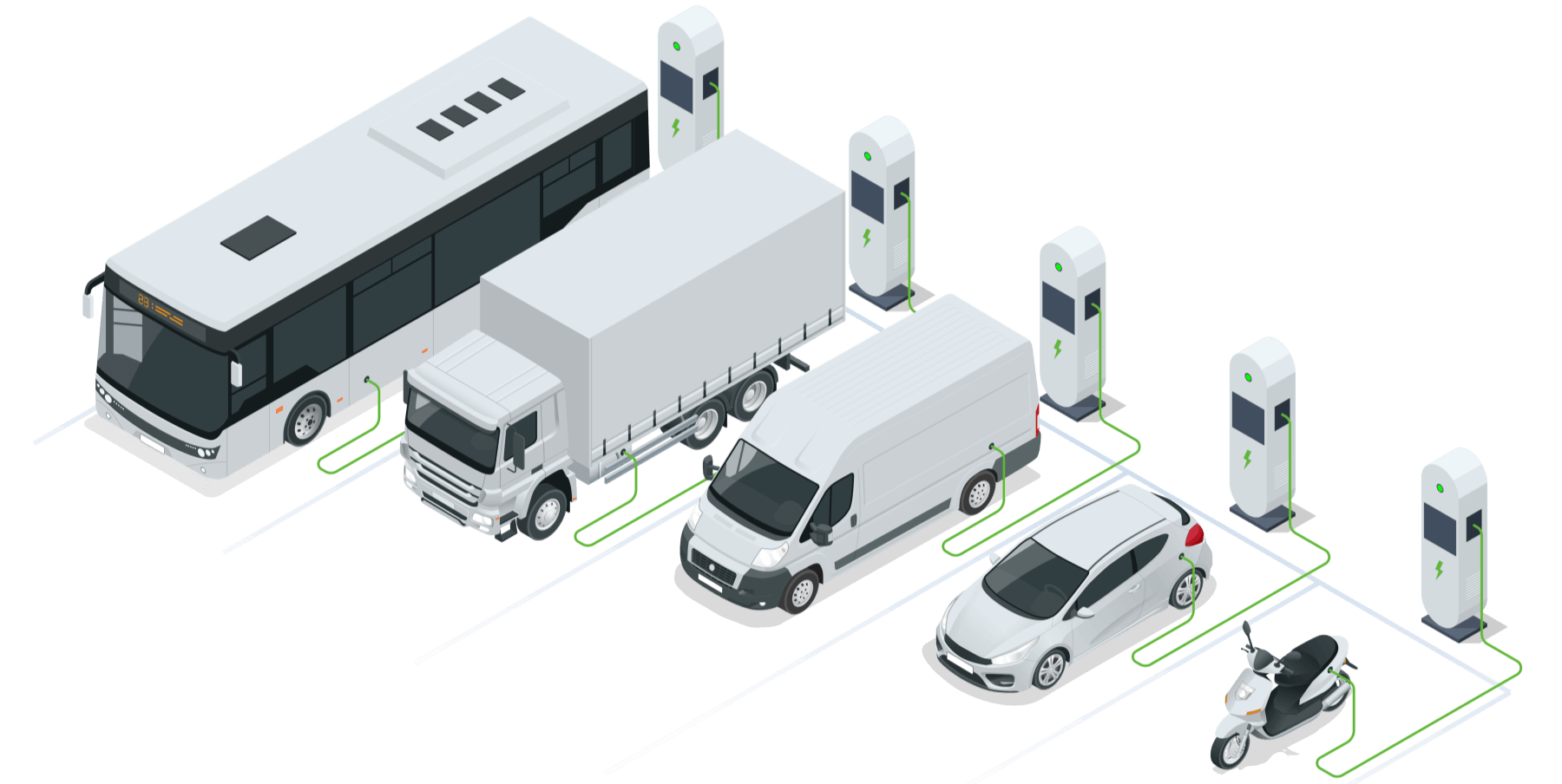

2024 China EV charging industry

With strong support from the Chinese government, the number of public DC chargers in 2024 China EV charging industry is expected to reach 1.729 million, with an annual increase of 526,000 units. The growth rate of public DC chargers shows a trend of accelerating development.

Industry forecast

The annual sales of electric vehicles are about to surpass the milestone of ten million units, making it undoubtedly exhilarating to discuss the development of supporting charging infrastructure!

Electric vehicle

According to the data, China’s production and sales of electric vehicles are expected to reach 9.587 million and 9.495 million respectively in 2023, with a year-on-year growth rate of 35.8% and 37.9%, achieving a market share of 31.6%.

Additionally, the China Association of Automobile Manufacturers predicts that the production and sales of electric vehicles will reach approximately 11.5 million units in 2024, representing an increase of around 20% and accounting for one-third of the automobile market, potentially setting a new historical record.

Electric vehicle supply equipment

In terms of charging infrastructure, as of the end of 2023, the cumulative number of nationwide charging stations reached 8.596 million units, representing a year-on-year increase of 65%. The annual growth in charging infrastructure was 3.386 million units, while new energy vehicle sales reached 9.495 million vehicles, resulting in a charger-to-vehicle ratio of 1:2.4.

By the end of 2023, there were 1.203 million public DC fast chargers, an increase of 442 thousand compared to the previous year. It is projected that by 2024, this number will reach 1.729 million units with an annual increase of 526 thousand units and a slight improvement in the charger-to-vehicle ratio compared to the previous year.

The construction speed for charging infrastructure continues to outpace the growth in new energy vehicle numbers.

Industry speculation

With an increase in electric vehicle sales, there will be more regulations related to electric cars and a greater demand for supporting facilities such as charging stations.

Luca de Meo, President of the European Automobile Manufacturers Association and CEO of Renault emphasized that from now until 2030 automakers are expected to face more regulations with some conflicting each other; therefore, deployment speed for charging stations needs to be accelerated at a rate seven to ten times faster.

The increased demand for electric vehicles will also drive manufacturers to introduce more models. Luca de Meo mentioned that over the next few years there will be more conventional electric cars available with a range between400 and500 kilometers and these EVs are expected to see significant price reductions.

Charging module market

In 2017, State Grid proposed the ‘constant power’ charging standard, which led to the dominance of 20kW constant power charging modules in the market. However, as we enter 2023, there is a clear trend towards higher power development in charging modules.

Overall, 20kW and 30kW modules have gained significant market share, with sales of the latter increasing rapidly due to the growing application of high-power charging stations.

In fact, high power and wide voltage range are widely recognized by the industry as essential for module product upgrades.

With a significant increase in the production and sales volume of charging modules, the price of charging modules decreased from approximately 0.8 yuan/watt in 2015 to around 0.13 yuan/watt by the end of 2019.

In the following three years, due to the COVID-19 pandemic and chip shortages, the price curve remained stable with slight declines and occasional rebounds.

As we enter 2023, with an increase in the construction of charging facilities, both production and sales volume of charging modules are expected to rise further, leading to a further adjustment in their prices.

Charging module trends

Currently, the development direction of charging module technology can be broadly divided into three categories based on their cooling methods.

The first category is the direct ventilation type module, which is the mainstream product in the market and produced by all module companies.

The second category includes modules with independent air ducts and gel isolation, The former is represented by “UUGreen Power” and “Cloud Charging”, while the latter is represented by “Infypower” and “Tonghe”.

The third category is fully liquid-cooled heat dissipation charging modules, represented by “Infypower” and “Huawei”.

Air-cooled modules are currently the most widely used charging module products. However, due to harsh environmental conditions, they suffer from high failure rates and relatively poor heat dissipation capabilities. In order to improve reliability and lifespan, charging module companies have developed independent air ducts and isolated air duct products.

These products bridge the gap between air cooling and liquid cooling, offering diverse application scenarios and market potential. It is worth noting that liquid-cooled charging modules are widely regarded as the optimal solution for the development of charging module technology. Currently, not all companies have achieved full mastery of the integration capability of fully liquid-cooled modules and systems due to certain technological barriers.

On the other hand, in terms of current types, existing charging modules include AC-DC charging modules for unidirectional charging piles which are the most widely used and abundant type of charging module, DC-DC charging modules applied to charge batteries from photovoltaic systems or charge vehicles from batteries commonly used in solar storage projects or energy storage projects, and bidirectional V2G (Vehicle-to-Grid) charging modules designed to address future requirements for vehicle-grid interaction functionality or bidirectional charging at energy stations.

Summary

Supported by strong government policies, the total number of EV charging stations in 2024 China EV charging industry is expected to grow rapidly. With the construction of more high-power and liquid-cooled supercharging equipment, the value will steadily increase. The next 2-3 years will provide a golden opportunity for structural adjustments and tiered development in the charging station and module industries, leading to expanded operations and breakthroughs within the sector.

0 Comments